Whether you are looking for a charming home in the heart of Salado or a ranch in rural Bell County, getting an offer accepted is a huge milestone. But at Century 21 Bill Bartlett, we know that an executed contract is just the beginning of the journey, not the finish line.

Understanding why real estate deals can collapse is the best way to ensure your move stays on track. Here are the most common pitfalls in the Texas market and how our team acts as your “transaction quarterback” to protect your interests.

1. Financing Hurdles Beyond the Pre-Approval

A pre-approval letter is essential for shopping for Bell County real estate, but it isn’t a 100% guarantee. Lenders re-verify your financial status right up until closing. New debt, late bills, or job changes can derail a mortgage. A sudden rise in interest rates can also change what a buyer qualifies for.

Our support: We help buyers by coordinating with lenders early, help sellers evaluate the true financial strength of every offer, and monitor timelines in the contract.

2. Inspection “Deal-Killers”

Home inspections are designed to protect you, but they can often surface unexpected issues. Major findings can lead to requests for big-ticket repairs, credits or even contract cancellation. And sometimes, a lender won’t finalize a loan unless specific repairs are completed or conditions are met.

Our support: We help identify “red flags” early, assist in analyzing inspection reports, and negotiate repairs to keep the deal together.

3. Appraisal Comes in Low

In a market like Bell County, appraisals are a critical step for financed purchases. Lenders generally won’t lend more than the appraised value. If the value is lower than the contract price, the buyer may provide extra cash, the seller may drop the price, or the deal may fail.

Our support: We use robust market analyses to help sellers price accurately from day one and negotiate creative solutions if appraisal gaps occur.

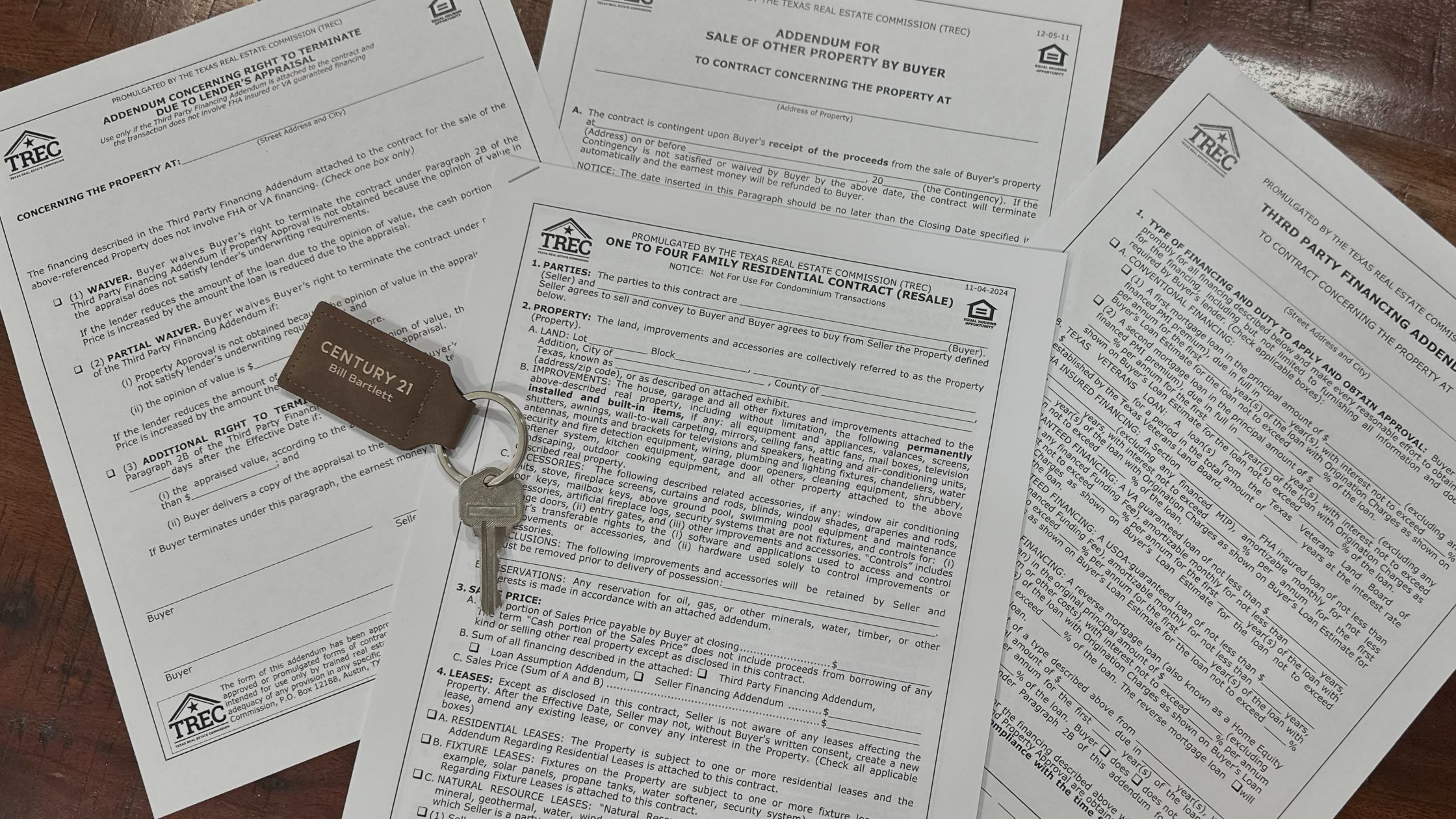

4. Contingencies & Deadlines

Texas real estate contracts can contain several “escape hatches” known as contingencies. These include the third-party financing contingency (buyer must secure their loan), appraisal contingency (the home must appraise at or over the sales price), and contingency for sale of other property (where a buyer must sell their current home first).

Our support: We diligently track every deadline and explain the risks versus benefits of each contingency.

5. Unexpected Title and Legal Issues

Title work ensures there are no hidden claims or liens on the property. Unpaid taxes, boundary disputes, or ownership claims can surface late in the process.

Our support: We work closely with local title companies to recommend early reviews, resolving these issues before they jeopardize your closing.

6. The “Option Period”

In Texas, it is standard for buyers to pay for an “Option Period,” which gives them the unrestricted right to back out for any reason. This could be due to a change in life circumstances, cold feet, inspection results, or a simple change of mind.

Our support: We help vet the earnestness of buyers and strength of their offers, set clear expectations, and provide the market insight needed to keep both parties focused and calm through the stress points of a transaction.

Why Choose CENTURY 21 Bill Bartlett?

Real estate contracts are legally binding documents filled with precise obligations and deadlines. Whether you’re a buyer or a seller, we’re here to help you move confidently from “under contract” to “closed”. If you’re looking for a Salado or Bell County agent that stays one step ahead and protects your deal, we would love to connect with you and discuss your move!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link